In today's dynamic business environment, it is crucial to optimize your operations for efficiency and accuracy. Managing Goods and Services Tax (GST) and Tax Deducted at Source (TDS) can be a complex and time-consuming process. Nonetheless, with the right tools, you can streamline these tasks significantly, freeing up valuable resources to focus on core business strategies.

Dedicated GST and TDS systems offer a range of features intended to simplify compliance. These encompass automated tax calculations, generation of reports required for filing, and seamless link with your existing accounting applications. By leveraging these tools, businesses can improve their financial management, reduce the risk of errors, and ensure timely compliance with regulatory requirements.

- Selecting the right software solution depends on your specific business needs and size. Consider factors such as ease of use, reporting capabilities, and customer support.

- Investing in GST and TDS software can provide a significant return on investment by saving time, reducing errors, and optimizing overall operational efficiency.

Mastering XBRL Reporting for Seamless Compliance

In today's complex regulatory landscape, accurate and timely financial reporting is paramount. XBRL (Extensible Business Reporting Language) has emerged as the industry standard for electronic data exchange, enabling organizations to submit standardized financial statements to regulators with ease. Utilizing XBRL reporting best practices can substantially streamline the compliance process and minimize the risk of errors or delays. By adopting a robust XBRL reporting strategy, companies can enhance their financial reporting workflow, confirm data accuracy, and achieve regulatory compliance with confidence.

- Businesses should invest in in-depth XBRL training to equip their employees with the necessary skills and knowledge.

- Identifying a reputable XBRL software solution can significantly streamline the reporting process.

- Regularly reviewing and updating XBRL taxonomies is crucial to ensure compliance with evolving regulations.

E-Invoicing: Revolutionizing Tax Management

E-invoicing is transforming the landscape of tax management. By automating invoice generation and sending, businesses can significantly reduce errors, improve efficiency, and gain valuable insights for informed decision-making. Moreover, e-invoicing enables real-time tax filing, reducing the risk of penalties and ensuring a smooth audit process.

- E-invoicing offers businesses a tactical edge by enhancing their operational efficiency.

- Immediate tax compliance can be achieved through e-invoicing, reducing the risk of penalties.

- Streamlined invoice processing leads to significant cost savings for businesses.

Conquering Payroll Complexity with Automated Solutions

Managing payroll can be a complex task, especially for organizations of any size. With ever-increasing regulations and the need to ensure accuracy, it's vital to have a efficient payroll system in place. Fortunately, automated payroll solutions offer a effective way to navigate these complexities and streamline your payroll processes.

- Software-driven payroll systems can automate tasks such as figuring out wages, subtracting taxes, and generating payment summaries.

- This releases your resources to concentrate on more critical business initiatives.

- Furthermore, automated solutions often come with included features such as time tracking and regulatory adherence tools, significantly minimizing the risk of errors and penalties.

The Power of Tax Software

In today's complex financial landscape, overseeing tax compliance can be a daunting challenge. Fortunately, cutting-edge tax software offers a efficient solution to simplify this process. By automating many aspects of tax preparation and filing, software empowers taxpayers to successfully meet their requirements.

Furthermore, tax software often provides valuable features to help users optimize their tax liability. From identifying eligible deductions and credits to generating accurate returns, tax software facilitates the entire tax process, freeing up valuable resources.

- Think about features like cloud-based access

- Linkages with other financial software

- Customer support

Enhance Your Tax Management Workflow with GST Software

In today's dynamic business environment, managing more info your Goods and Services Tax (GST) can be a challenging task. Fortunately, powerful GST software solutions are accessible to revolutionize your tax management workflow. These tools are designed to streamline key processes, saving valuable time and resources.

- Implement GST software to accurately calculate and file your tax returns, ensuring compliance with all regulatory requirements.

- Create comprehensive reports on your GST activities to track your tax position.

- Process your invoices, credits, and refunds effectively, eliminating the risk of errors and inefficiencies.

Through adopting GST software, businesses can gain a strategic advantage by optimizing their tax management systems. It enables greater visibility, reduces compliance costs, and allocates resources for expansion.

Jonathan Taylor Thomas Then & Now!

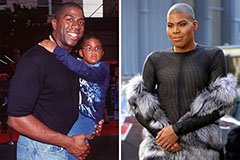

Jonathan Taylor Thomas Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!